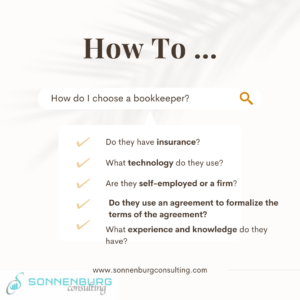

The reasons for hiring a bookkeeper may seem obvious if you are an overworked business owner doing your own books and need to focus on generating revenue and managing your business.

Many businesses already have a bookkeeping solution that could utilize an employee, a spouse, a self-employed bookkeeper, staff in their tax preparer’s office, an offshore firm, or a dedicated bookkeeping firm. Most businesses don’t know what to look for in a bookkeeper depending on their needs, but they know they need help, so I wanted to share the things you may want to consider when hiring a bookkeeper.

1. Insurance

It’s important to confirm that your accounting firm carries the proper insurance coverage including general liability, professional liability (if relevant), data security coverage, and employee fraud (if they have employees).

2. Technology

Accounting firms need to ensure that they are using a knowledgeable IT company for data security, backups, etc. They also need updated hardware and software to ensure that they can efficiently and effectively work on company files while keeping all data secure. Old methods of hand-writing checks and manual entries take a lot of time and can have a larger margin for error. You may be using the old method, but your accounting firm may be able to offer an upgraded solution and should be offering that to you.

3. Self-employed person or a firm?

Confirm whether they have others (besides themselves) that are familiar with the file and can assist when the primary bookkeeper is unavailable, and decide whether that is important for your situation.

If they have employees, many accounting firms, like other businesses, use offshore assistance because it is an inexpensive option. Other countries have different data security standards (typically lower than in the U.S.) so you want to ensure that your sensitive data is secure.

Are they available year-round to work on the file? Some businesses have the staff in their tax preparers office handle their bookkeeping. If this is your solution, ensure that they are available throughout the year and not just in their off season to take care of regular maintenance. It is common for a tax preparer’s office to save the maintenance and catchup for the off season once returns are filed by the deadlines and leave your books 4 to 6 months behind until they can update your file.

Is it a relative or close friend? Careful consideration should be given to this. Finances are not something that most people are comfortable sharing with even their closest loved ones. You want to ensure that others won’t have access to your financial information and this is difficult to do with friends and relatives. We have seen couples unexpectedly divorce and then both parties argue over the condition of the books of the business when a spouse has been doing the books. Consider always having an unrelated third party perform this important function for the unforeseen, as an accounting firm is required to keep your information confidential.

4. Do they use an agreement to formalize the terms of the engagement?

This is typically only an issue with friends, relatives, and self-employed bookkeepers that are not well-established, but it’s important to understand pricing and services available whenever entering into an agreement.

5. Experience and knowledge

You, your spouse, or in-house employee are not likely doing any continuing education to understand the ever-changing laws concerning tax deductions and reporting. It’s important to note that while continuing education is encouraged by the IRS, it is not required for bookkeepers. It takes years of experience dealing with different types of entities, industries, etc. to understand proper accounting so finding a bookkeeper with plenty of experience, or a firm with an experienced accountant regularly reviewing your file is important.

Another consideration is having financial statements prepared by a third party for lenders, landlords, partners, investors, tax preparers, business consultants, etc. Ensuring that an experienced professional is creating the financial statements with the data you have provided and ensuring that the data is complete and accurate is vital when providing financial statements to anyone outside of your business.

I hope this information is helpful in determining your bookkeeping needs for your business!